- Features

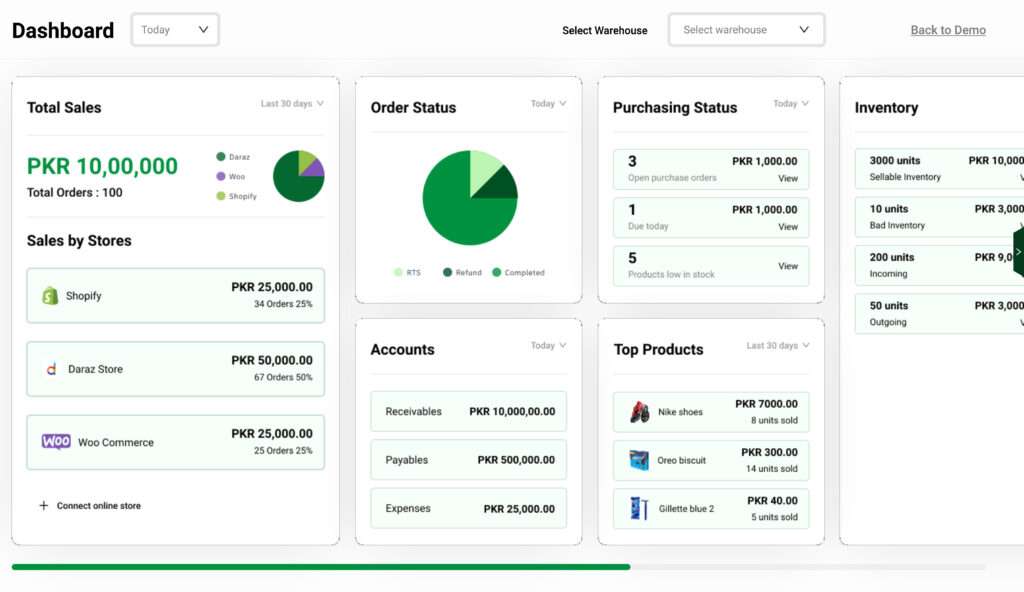

Inventory Management

A 360° view of all your inventory from all the locations at one place.

Order Management

Order workflows, order status sync & return management for all your sales channels.

Shipping Management

Bulk ship now with our easy-to-use software and print labels for fulfillment

Accounting Management

Digitize and automate your entire accounting process with a highly sophisticated built-in accounting module.

Reporting

Make informed business decisions from data savvy reports offering actionable insights.

Point of Sales (POS)

FBR integrated Point of Sales System (POS) that allows retailers like you to sell from multiple retail outlets

- Integrations

- Resources

Blog

Asaan Retail updates and long-form articles for small businesses

User Guides

Find all user education material and guides here

Release Notes

Stay up-to-date with our latest features, changes and fixes

Request Support Callback

Get expert advice and see if Asaan Retail is the right fit

Webinars

Visit our digital library of all educational videos here

Webinars

Visit our digital library of all educational videos here

- Company

About Us

On a mission to enable retailers to sell and grow efficiently.

Contact Us

Connect over the phone or email us your questions

Customer Stories

Read what our clients have to say about Asaan Retail here.

Careers

Click here to join our winning team

- Partners

- Pricing

- Get a Demo

- Features

Inventory Management

A 360° view of all your inventory from all the locations at one place.

Order Management

Order workflows, order status sync & return management for all your sales channels.

Shipping Management

Bulk ship now with our easy-to-use software and print labels for fulfillment

Accounting Management

Digitize and automate your entire accounting process with a highly sophisticated built-in accounting module.

Reporting

Make informed business decisions from data savvy reports offering actionable insights.

Point of Sales (POS)

FBR integrated Point of Sales System (POS) that allows retailers like you to sell from multiple retail outlets

- Integrations

- Resources

Blog

Asaan Retail updates and long-form articles for small businesses

User Guides

Find all user education material and guides here

Release Notes

Stay up-to-date with our latest features, changes and fixes

Request Support Callback

Get expert advice and see if Asaan Retail is the right fit

Webinars

Visit our digital library of all educational videos here

Webinars

Visit our digital library of all educational videos here

- Company

About Us

On a mission to enable retailers to sell and grow efficiently.

Contact Us

Connect over the phone or email us your questions

Customer Stories

Read what our clients have to say about Asaan Retail here.

Careers

Click here to join our winning team

- Partners

- Pricing

- Get a Demo

- Features

Inventory Management

A 360° view of all your inventory from all the locations at one place.

Order Management

Order workflows, order status sync & return management for all your sales channels.

Shipping Management

Bulk ship now with our easy-to-use software and print labels for fulfillment

Accounting Management

Digitize and automate your entire accounting process with a highly sophisticated built-in accounting module.

Reporting

Make informed business decisions from data savvy reports offering actionable insights.

Point of Sales (POS)

FBR integrated Point of Sales System (POS) that allows retailers like you to sell from multiple retail outlets

- Integrations

- Resources

Blog

Asaan Retail updates and long-form articles for small businesses

User Guides

Find all user education material and guides here

Release Notes

Stay up-to-date with our latest features, changes and fixes

Request Support Callback

Get expert advice and see if Asaan Retail is the right fit

Webinars

Visit our digital library of all educational videos here

Webinars

Visit our digital library of all educational videos here

- Company

About Us

On a mission to enable retailers to sell and grow efficiently.

Contact Us

Connect over the phone or email us your questions

Customer Stories

Read what our clients have to say about Asaan Retail here.

Careers

Click here to join our winning team

- Partners

- Pricing

- Get a Demo